Foreign investors snap up 70% of all central London new build homes fuelling a surge in prices

New build residential prices in the capital have soared by 56.3 per cent between January 2009 and June 2013

Investment in luxury new build homes hit £2.2billion last year

Investors from China, Russia and the Middle East are snapping up new build properties in London and fuelling a surge in prices, research has found.

Around 65-70 per cent of new build homes – which foreign buyers prefer – in prime London locations have gone to overseas purchasers in the last two years, according to data from estate agents Chesterton Humberts.

This international appetite has resulted in new build residential prices in the capital soaring by a whopping 56.3 per cent from January 2009 to June 2013.

Foreign hotspot: Central London properties are being snapped up investors from far afield

Meanwhile house prices in London as a whole have risen by 8.1 per cent, according to the latest figures from the Office for National Statistics.

There has also been an increase in buyers from other countries looking primarily to purchase properties for investment purposes, according to Chesterton Humberts,

It has identified a number of nationalities that are becoming more active in the London property market – including Nigerians, French and Greeks – due to political strife, economic difficulties and tax threats to personal wealth.

London’s established safe haven status, combined with its legal transparency and the good long term performance of its property market, means that it features on many international buyers’ wish lists.

Price growth has been particularly strong over the past few years with Nationwide reporting that average new build capital values have risen by 47.7 per cent since 2009, while the average premium for luxury new build property in London can be anything from 10-15 per cent and in some cases considerably higher.

Samuel Warren, head of international residential developments, highlighted that there was £2.2billion of investment in luxury new build homes last year and expects the figure will be exceeded this year.

He said: ‘With demand for prime new build properties set to remain robust and new supply struggling to keep up, we expect investment volumes will be higher this year than last.

‘The relative weakness of sterling means that many overseas buyers can achieve effective discounts on purchase price whilst acquiring an asset that will almost certainly appreciate considerably over time and which they will have little difficulty in selling when the time comes.’

However critics have raised concerns about just how high central London property prices have risen in comparison to the rest of the UK and have questioned whether the price boom can continue indefinitely.

Why do foreign investors love to buy new build property in London?

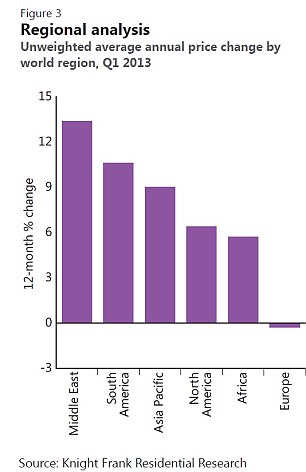

Bucking the trend: European property prices have fallen – but London values remain strong

Foreign investors want to buy a slice of London new build property.

The Battersea Power Station development, for example, sold out of most of its 866 luxury apartments within days – many to Singaporean investors looking for a safe haven.

Looking at Asian markets, it is clear to see why Far Eastern investment is soaring in London.

For example, Singapore has raised Stamp Duty for foreign and corporate buyers from 10 per cent to 15 per cent, only a year after the tax was first introduced. House prices were up 3.5 per cent there in March 2013 compared to 2012, according to Knight Frank.

In Hong Kong, taxes are even higher. In order to contain rising prices fuelled by rampant speculation and the influx of foreign investors, particularly from the Chinese mainland, the Government has implemented a Special seller’s Stamp Duty of up to 20 per cent on the sale of short term owned properties.

In addition it is introducing a 15 per cent buyer’s Stamp Duty on local and non-local companies. The moves come as house prices soared by a whopping 28 per cent in the 12 months to March 2013.

This means the Chinese are becoming locked out of these closer-to-home markets and now many see more value in London property.

Education is another major factor. London’s reputation for top quality education has resulted in 15 per cent of Chinese overseas students coming to the UK – and according to research, 82 per cent of affluent Chinese families are now planning to send their children to study overseas.

With three of the top ten world universities situated close to London, this is a clear focus point and drives a desire for prime real estate.

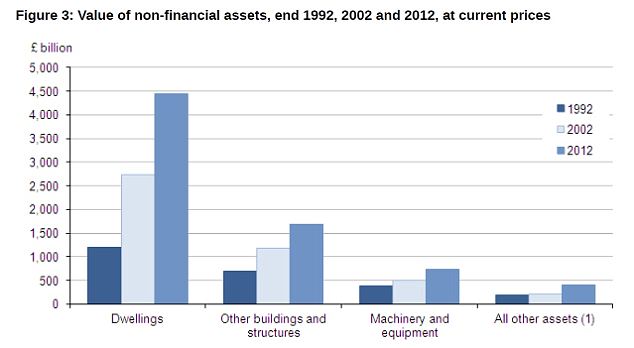

Bricks and mortar: Rising house prices mean UK property is on average worth four times as much as it was 20 years ago and now accounts for half the nation’s wealth

Over the last 16 years, prices in Central London postcodes have increased six-fold from £221,679 to £1.36million, according to HM Land Registry, outstripping returns from most other Asian markets.

The 70 per cent figure given by Chesterton is lower than research in June from estate agent network London Property Partners.

It reported that just 15 per cent of its sales in the past year were made by UK buyers. Of the foreign purchases, 80 per cent were from Europe and 20 per cent from Asia.